As financial professionals, we always talk about preparing for your financial future, but it’s also important to enjoy your savings.

We always discuss ways our clients can properly prepare themselves for the future. Today, however, we want to talk about something that we rarely consider as a possibility: being overprepared. It’s true. We’ve worked with clients who have had “too much saved,” and while that’s never a bad thing, so many of us are trained to continue saving at all costs, potentially pushing us to miss out on the reasons we saved that money in the first place.

This month, I’d like to stress the importance of enjoying what you have while you can. If you think you have more than enough to adequately support yourself and live the lifestyle you want and deserve in retirement, it may not be a bad idea to consider planning for gift giving, donations to nonprofits or spending money on memories that will last a lifetime.

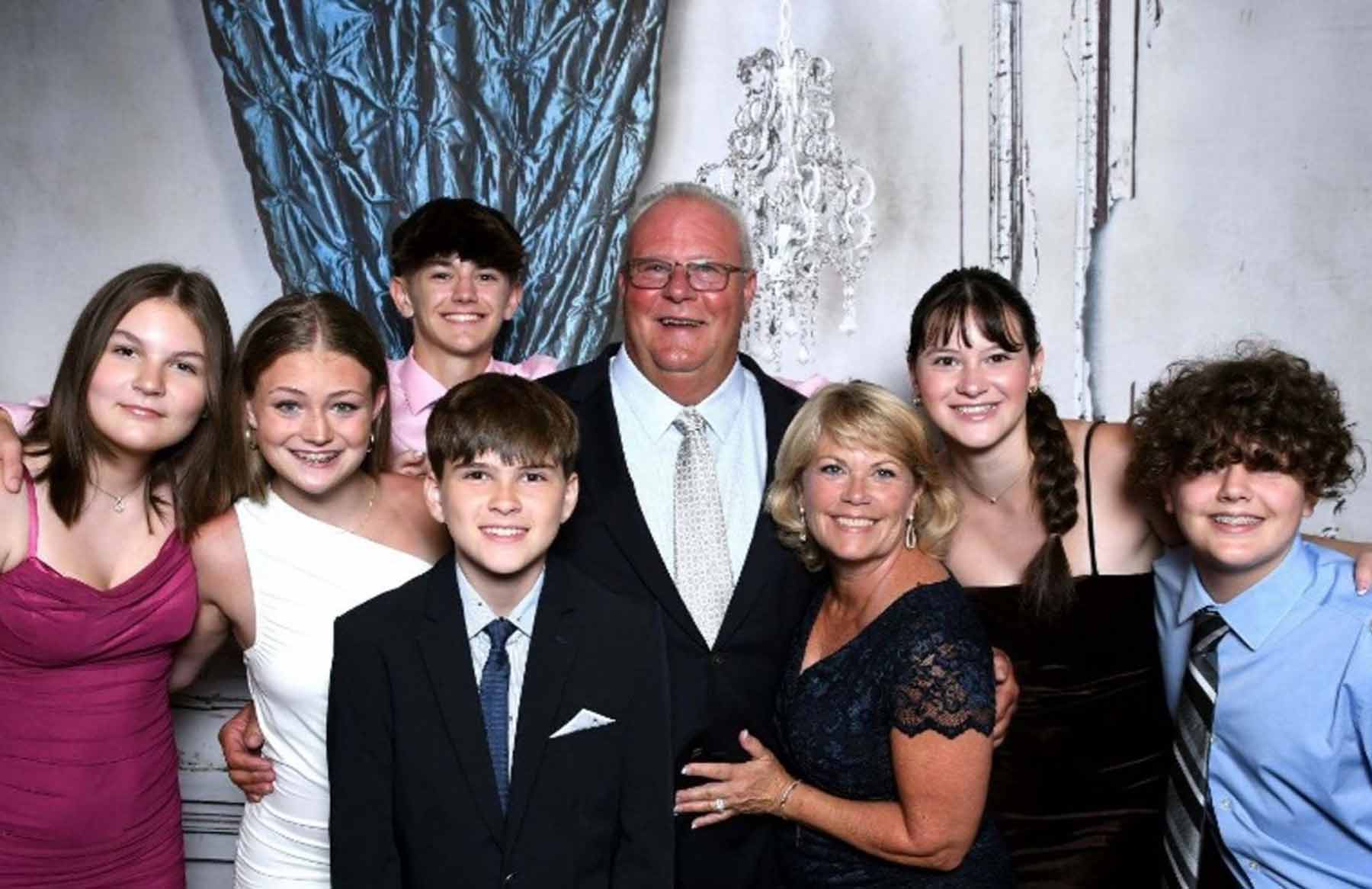

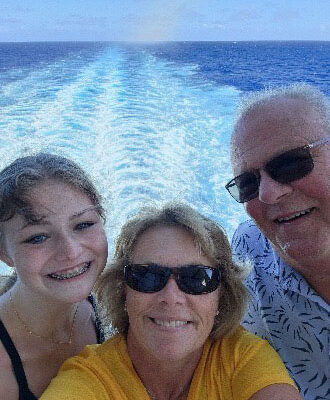

Our entire family recently took a cruise with all the expenses paid by my husband and me. As I said, we’ve been conditioned to be afraid to spend like this, as we expect to use all of our funds to pay for our desired lifestyle in retirement. It was certainly a mental hurdle we overcame, but in the end, we couldn’t be happier that we were able to provide this experience for our grandchildren. Though it certainly dug into our savings, we don’t regret it in the slightest, and we don’t believe that a price can be put on these types of memories.